If it feels like tariffs and trade wars are dominating the headlines in 2025—you’re not alone. Lately, it’s been hard to keep up with the rapid-fire changes in global economic policy. And if you’re like us, you’ve probably found yourself in an impromptu crash course on international trade and the global supply chain.

From the get-go, President Trump made tariffs a cornerstone of his re-election platform. On day one back in office, he slapped a 25% tariff on imports from Mexico and Canada, setting the tone for what’s become a whirlwind of policy shifts.

Since that first move, the administration has kept up a rapid pace—announcing new tariffs nearly every week, then reversing course just as fast. Things really escalated on April 2nd, dubbed Liberation Day by the White House, when Trump announced reciprocal tariffs on 140 countries, all aimed at correcting trade deficits with U.S. partners around the world.

This is a big deal for the ebike industry. Much of the world’s manufacturing—especially for bike frames, lithium-ion batteries, and critical components—happens in countries like Vietnam, Taiwan, India, and China. That means these tariffs could impact everything from pricing to product availability.

In this article, we’ll break down what’s going on, what it means for the ebike world, and try to answer the big question: Should you buy an ebike now, or wait it out?

What Is the Current Tariff Situation?

That’s the big question everyone’s asking—and unfortunately, there’s no simple answer.

While the official motives behind the Trump administration’s trade strategy remain murky, many analysts believe the president is using tariffs more as a bargaining chip than a long-term policy. The idea? Leverage the threat of economic disruption to force a renegotiation of global trade deals. But whether these tariffs are temporary or not, their impact is already being felt.

If the U.S. were to fully implement the proposed tariffs, Americans could see price hikes across the board—on everything from electronics and lumber to gas, groceries, and alcohol. The ripple effect would hit both consumers and businesses, including ebike manufacturers that rely on parts and components from abroad.

So far, Trump’s aggressive tariff play has rattled global markets, strained diplomatic relations, and left entire industries—ebikes included—scrambling to make sense of what’s next. Both Wall Street and Main Street are operating under a cloud of uncertainty and unease.

Here’s a quick timeline of the major tariff events that have unfolded since Trump returned to office. This isn’t a complete list, but it gives a sense of the pace and scale of the changes.

Feb. 1 — Tariffs on Canada and Mexico

President Trump signed an executive order slapping a 25% tariff on nearly all imports from Canada and Mexico, along with a 10% tariff on goods from China. According to the administration, this move was designed to combat fentanyl smuggling and illegal immigration. In retaliation, both Canada and Mexico quickly announced tariffs of their own.

Feb. 3 — Not So Fast…

Just two days later, Trump hit the brakes. The administration paused the tariffs on Mexico and Canada for 30 days and redirected its focus toward the European Union—threatening yet another round of duties.

Feb. 10 — Steel and Aluminum Tariffs Return

Trump reinstated the 25% tariff on foreign steel and aluminum that originally defined his first term’s trade policy, reigniting tensions with several key trading partners.

March 4 — Tariffs Go Into Effect

After the 30-day delay, the previously announced tariffs on imports from Canada, Mexico, and China officially took effect. All three of America’s top trading partners were now facing a 25% tariff. In response, Canadian Prime Minister Justin Trudeau hit back with a 25% tariff on $155 billion worth of U.S. goods.

April 2 — Global 10% Tariff Shocks Markets

President Trump rolled out a sweeping 10% baseline tariff on all imports, with significantly higher rates targeting specific nations—most notably, a 34% tariff on goods from China. The market reaction was swift and brutal. The S&P 500 dropped 5%, the worst single-day decline since March 2020.

April 4 — China Hits Back

China’s Finance Ministry responded with matching 34% tariffs on U.S. imports and placed 11 major American companies on its “unreliable entities” list, effectively blacklisting them from doing business in China. By week’s end, the Dow was down 11%, and the S&P had fallen 12%.

April 9 — Reciprocal Tariffs Shake Global Trade

In what the administration called the most sweeping trade action yet, Trump enacted reciprocal tariffs affecting more than 90 countries. The numbers were eye-popping: 104% tariffs on Chinese goods, 20% on European imports, 24% on Japanese products, and 46% on goods from Vietnam.

China didn’t wait long to strike back. Within 12 hours, it implemented an 84% tariff on all U.S. exports, bringing trade tensions to a boiling point.

April 9 (Evening) — A Sudden Pause

Then, in typical fashion, the administration reversed course again. Just hours after the tariffs were supposed to take effect, Trump announced a 90-day pause and set a universal tariff rate of 10% while trade negotiations continued. The only exception? China, which is still operating under a punishing 125% tariff as of this writing.

The takeaway? The current tariff landscape is more like shifting sand than solid ground. With policies changing by the day—and sometimes by the hour—it’s nearly impossible for companies to plan ahead. For the ebike industry, where product cycles stretch over multiple years and components come from all corners of the globe, that kind of volatility is a nightmare.

Why This Is Bad News for the Ebike Industry

Tariffs might make for bold headlines, but for the ebike industry, they’re creating the worst kind of uncertainty. This is a still-maturing market where stability is crucial. Manufacturers are trying to get their footing, and a chaotic, shifting tariff landscape only throws a wrench into already fragile supply chains.

Over the past two years, we’ve seen promising names like Juiced Bikes and VanMoof file for bankruptcy protection—both early innovators that helped shape the current ebike landscape. And while many companies are still reeling from the last round of tariffs, they’re now being hit with a fresh wave of unpredictability. The result? A slowdown in growth and investment at a time when the industry should be scaling up.

You’re seeing similar hesitation in other sectors too. Take the much-anticipated Nintendo Switch 2 as an example. Preorders were paused amid concerns that production costs could spike due to the latest tariff news. When companies can’t predict what their margins will be, launching a new product becomes a high-risk gamble. That same logic applies—if not more so—to ebikes.

A Complex Supply Chain Suddenly in Crisis

Building an ebike isn’t like putting together a simple gadget. The product cycles are long, and the components involved—motors, lithium-ion batteries, derailleurs, braking systems, grips, seats—are sourced from multiple suppliers, often across several countries. Managing that web of production is difficult enough under normal circumstances. Tariffs add a layer of chaos that even the most efficient operations struggle to handle.

This is especially challenging for smaller and mid-sized ebike brands that don’t have the deep pockets or political connections of bigger players in more established industries. About 90% of the companies we cover rely on overseas manufacturing and assembly. Components are built abroad—often in China, Taiwan, or Vietnam—before being shipped to the U.S. for distribution.

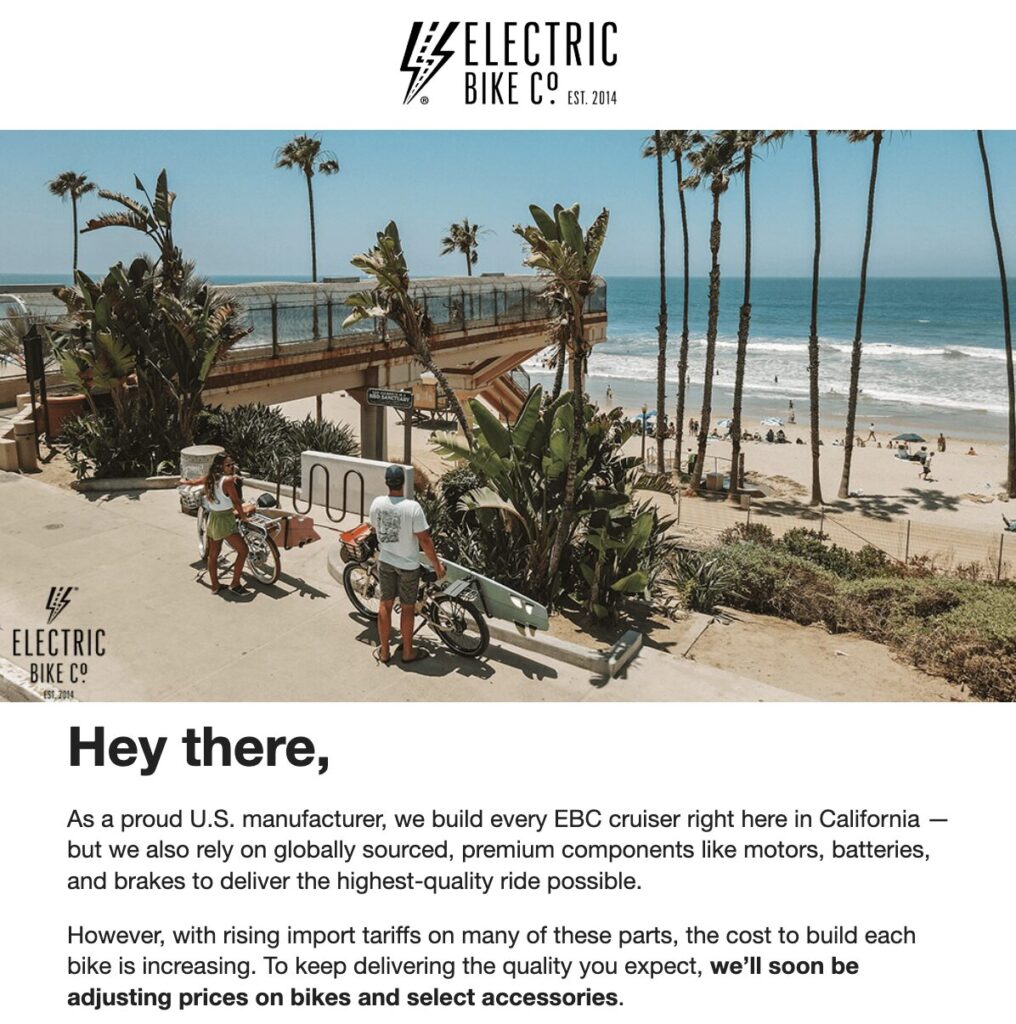

Yes, there are exceptions. Companies like the Electric Bike Company have taken the rare step of assembling bikes domestically. They even produce some accessories, like fenders and chain protectors, in-house. But these are outliers. Brands like Lectric and Aventon still rely heavily on overseas production because that’s where the infrastructure exists—and where the costs are still manageable.

The High Cost of Domestic Production

There’s a reason the U.S. doesn’t have a large domestic ebike manufacturing base: it would take years and massive capital to build one. China and other countries already have the factories, tooling, labor force, and supply networks to produce frames and batteries at scale—and at prices U.S. companies simply can’t match.

So when policymakers send mixed signals about trade, it becomes nearly impossible for companies to chart a long-term course. Why invest millions in a new U.S. facility if there’s a real chance those tariffs could be rolled back—or tightened—even before the concrete dries?

That’s why we’re seeing most ebike companies adopt a “wait and see” approach. Until there’s more clarity from the administration, don’t expect a flood of domestic manufacturing announcements or bold new product launches. The stakes are simply too high, and the guidance too unpredictable.

How Ebike Companies Are Reacting to Trump’s Tariffs

When it comes to the ebike industry’s response to the new wave of tariffs, it’s a bit of a mixed bag.

Most companies aren’t making any sudden moves. Instead, they’re holding steady and waiting to see how this all shakes out. After all, this isn’t the first time the industry has had to navigate trade turbulence. Many brands weathered similar storms during Trump’s first term and again under the Biden administration’s own tariff policies. If there’s a silver lining, it’s that the sector might be a bit more battle-tested this time around.

Lectric Ebikes, for example, saw the writing on the wall years ago. The company strategically shifted much of its manufacturing to other parts of Asia, choosing countries with lower tariff exposure. That kind of foresight could prove crucial as the current uncertainty plays out.

Other brands, however, may not have the same flexibility. Relocating a supply chain is no easy task, and many companies simply can’t afford to make sweeping changes until they know the new rules of the game. As a result, we’re seeing a “wait and see” approach across much of the industry.

Here at the blog, we’ve been tracking these developments closely—watching how manufacturers adjust and what this all means for consumers. If you’re in the market for an ebike, it’s worth paying attention. Tariff-driven price changes could hit suddenly, and in some cases, you might end up paying hundreds more for the exact same model just a few weeks later.

Aventon

- Announced tariffs would cause prices to increase on April 11 but then paused because of uncertainty

- Aventon Aventure 2 – Sale price at $1699 (Original price $1999)

- Aventon Abound – Sale price at $1599 (Original price $1999)

Ride1up

Rad Power Bikes

- Rad Power Bikes has been quiet on tariffs as of late but is running an Earth Day Sale right now and select models are up to $699 off right now so it’s probably a good time to buy a Rad bike anyway.

- Perhaps one of the reasons Rad is not raising prices is because they already announced price increases back in June in response to Biden era tariffs to China.

- RadRover 6 Plus – Save $699 (Original price $1599)

- Every RadRunner – $500 Off (RadRunner™ 3 Plus, RadRunner™ 2, and RadRunner™ Plus)

Velotric

- Based on this Reddit post that we were able to dig up Velotric had planned to increase bike prices on April 15th as a result of tariffs but it appears they did not follow through. Another example of a brand that is taking a wait and see approach.

EBC

- The Electric Bike Company makes no secret of the fact that all their bikes are assembled by hand here in the US. They also manufacture many of their own accessories domestically. Founder Sean Lupton Smith has been very outspoken about the need for tariffs to create a level playing field for US based ebike companies and seems to be in favor of these tariffs based on some of his comments.

- That being said, we were able to track down a newsletter update from April 9th announcing EBC’s intention to raise prices. As far as we can tell, they have not raised prices yet but it seems like the writing is on the wall. Now might be a great time to purchase one using one of the discounts from our EBC deals page.

More Ebike “Tariff” Deals

Price Increases Coming Soon

Mokwheel – Last chance to save before price hike on April 30

Hovsco – Price increases take effect April 26, Easter Promotion still up

Vtuvia – Price increase starts May 1, ongoing Earth Day Sale

Haoqi – All models rising $50–$150 starting in May

KBO – “Prices Increasing Soon” notice on site; several models on sale

Wallke – Price hike expected soon so grabe an ebike in their ongoing Spring sale

Beecool – Spring sale may be the last chance before increases due to rising component costs

- Vanpowers – Final deals before price increase seen on their website